Great Tax Opportunities for Commercial Solar!

There are changes afoot in the Canadian solar energy landscape. Here is a summary for your reference. Warning: it’s a bit technical but there’s good news for businesses, so read on.

Clean Technology Investment Tax Credit

Announced in the Fall 2022 Economic Update, this refundable tax credit is available to taxable entities investing in clean energy technology, including solar electric net metered systems intended to offset grid electricity consumption. The credit is available for all project spending from March 8, 2023, through to the end of 2034. The available amount ranges from 20% to 30% of the project cost, depending on factors that are to be determined in the fall of 2023. (ie. The minimum tax credit is 20% irrespective of those TBD factors.) This tax credit is intended to encourage business investment in renewable energy, increasing deployment of clean energy across the country. Remember that tax credits are deducted from tax owing dollar-for-dollar. Refundable tax credits can result in a net refund in a scenario where no tax is owing, but remember that the tax credit is, itself, taxable income. Learn more about investment tax credits.

Clean Electricity Investment Tax Credit

This 15% tax credit is similar to above but is available to non-taxable entities, like municipalities, public utilities, Crown corporations, etc. It should also be available to churches but this needs to be confirmed.

Capital Cost Allowance (CCA) for Capital Classes 43.1 and 43.2

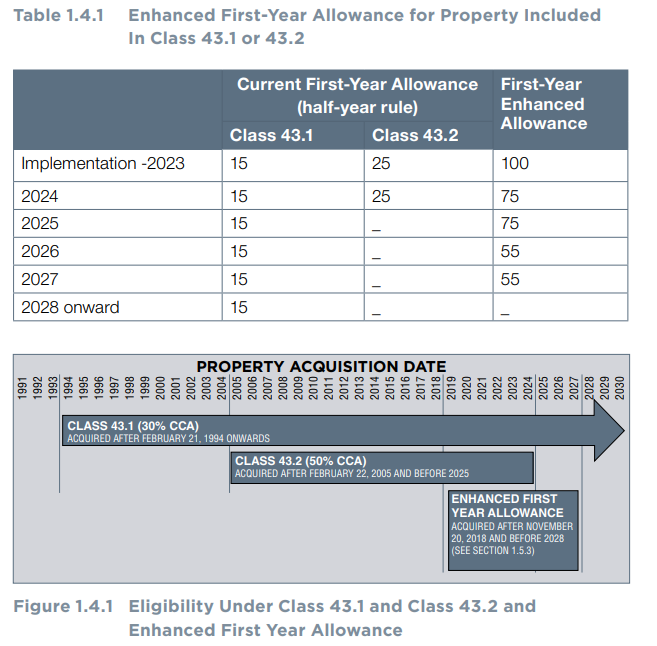

CCA is the portion of a capital investment eligible to be depreciated as an expense in a given fiscal year. The CCA rate is based on the class of the asset, which is set by the Canada Revenue Agency. Applicable classes for clean energy equipment are 43.1 and 43.2. The higher the CCA rate, the more of your investment you can depreciate each year. Year 1 has a half-year rule whereby only half of the eligible CCA can be claimed in year 1. (If you’re feeling energetic, you can look up the details in the CanMET Technical Guide to Class 43.1 and 43.2.) The difference between 43.1 and 43.2 is “timing”; specifically when was the asset acquired? 43.2 offers a higher CCA rate (that’s a good thing) for a specified limited time period, whereas 43.1 is ongoing. Solar energy systems are eligible for both 43.1 and 43.2 capital classes.

Enhanced First Year Capital Cost Allowance

For a limited time, capital assets in classes 43.1 and 43.2 are eligible for an enhanced year one capital cost allowance. For investments made in 2023, that enhanced first year allowance is 100%. This means 100% of the investment can be depreciated in year one. This can be an attractive tax opportunity, depending on your situation. Beginning in 2024 and continuing to 2027 the enhanced rate falls, returning to the base rate in 2028. Here’s a chart the shows the first year enhanced allowance rates and eligible years:

How Do You Capitalize on These Opportunities?

These are all tax initiatives and are applicable at tax time, after your capital investment is made. There is no eligibility test or application process, though there are tax filing requirements. For comfort, refer your tax accountant to this web page for corroboration; he/she can dig into the tax code themselves as needed. Ask about timing of investment vs your fiscal year vs the CRA fiscal year.

Contact us to discuss your project!

You may also like

- Diversity: Your Secret Weapon in Uncertain Times Read Article

- Reliability vs. Resiliency: Strategies for Backup Power Systems Read Article

- The dirt on the OHRS Program Read Article

- Preventative Maintenance for Off-Grid Applications: Essential! Read Article

- Do solar panels work in Winter? Read Article